For decades, the Forbes Billionaires List has served as a global scoreboard for wealth, influence, and ambition. But in 2025, that scoreboard flipped dramatically—a subtle earthquake at the very top, visible only to those paying close attention to the elite world of hyper-wealth.

This isn’t just an article about money. It’s about momentum, strategy, and the invisible rules of global valuation. This year, billionaires didn’t just trade spots—they exposed the tectonic shifts happening in tech, industry, and investor behavior.

And some, like Dangote, proved that being steady in turbulent times is just as powerful as sprinting to the top.

THE JUNE 2025 GLOBAL BILLIONAIRES

Elon Musk: The Unshakable Titan

No surprises at the top: Elon Musk retained his No. 1 spot with a net worth of over

Wealth: $410.8 billion

Why it matters: Musk’s empire—EVs, rockets, satellite internet, and X—opera from multiple high-volatility fronts. His net worth swings daily with Tesla stock and public sentiment.

June snapshot: A dip in Tesla’s shares netted a $34 billion drop mid-June, but recovery in EV demand and Starlink was enough to cement his lead .

Outlook: Diversification keeps him insulated, though regulatory ripples and stock fluctuations pose ongoing risk.

Larry Ellison: Oracle’s AI Phoenix

Larry Ellison remains the quiet accumulator, climbed to number 2 spot. The Oracle co-founder’s stake in enterprise cloud and database dominance, especially following massive AI-infrastructure deals with government agencies, made his wealth volatile yet high.

Wealth: $258.8 billion

Shift: A jaw-dropping $66.8 billion surge in just days—largest single jump in 2025 .

Why it happened: Stellar Q4 earnings ($15.9B rev, $1.70 EPS) swelled investor confidence. Oracle’s AI-first strategy—seen in “Stargate,” a government-AI initiative—sparked a 13–14% share rally .

Personal stake: Ellison holds ~41% of Oracle and remains CTO and chairman at age 80 .

Significance: A legacy tech leader outpaces Silicon Valley heirs—showing AI can reignite old giants.

Mark Zuckerberg: Meta’s Quiet Rebound

Wealth: $235.7 billion

Catalysts: AI-powered avatars, monetized metaverse ads, and engagement rebound helped boost stock nearly 18% in May .

Edge: With ~13% stake in Meta, Zuckerberg benefits more from stock surges than Bezos or others with lower equity exposure.

Next: Another solid quarter could propel him back to the No. 2 seat.

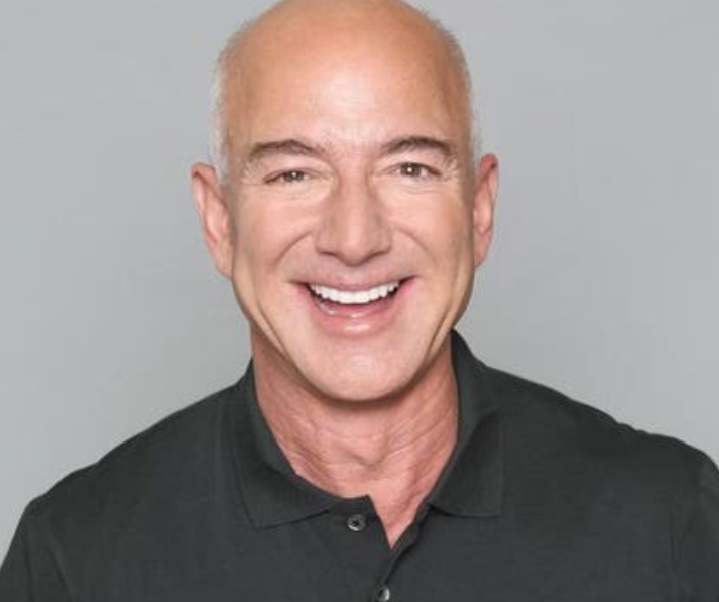

Jeff Bezos: The Subtle Descent

Jeff Bezos, Amazon’s founder, slipped to No. 4 after holding No. 2 for much of 2024. Despite Amazon’s continued strength in cloud computing (AWS) and logistics automation, a $5 billion divorce settlement finalized in early 2025 and a softening of Amazon stock shaved billions off his net worth.

Wealth: $226.8 billion

Why he fell: An 11% Amazon stock rise was overshadowed by Meta and Oracle’s spikes .

Equity impact: Bezos now holds ~9% of Amazon—lower than many peers—dampening his leverage .

Shift in focus: Heavy investment in Blue Origin, Day One Fund, and climate activism possibly slowed equity accumulation.

Implication: Diversification into legacy projects cost him ranking power.

5–8. The Steady Guardians

Warren Buffett (#5, $152B):

At 93 years old, Warren Buffett is the rare billionaire whose popularity has only grown. Berkshire Hathaway’s performance in utilities, rail, and insurance remained strong.

Berkshire remains stable, though retirement buzz nudged a slight share dip.

Larry Page & Sergey Brin (#6–7):

Larry Page and Sergey Brin, the quiet co-founders of Google, each saw their wealth climb thanks to Alphabet’s AI expansion and dominance in search-advertising infrastructure.

Alphabet reaps AI gains from Google Cloud, Bard, and Gemini .

Bernard Arnault (#8, $178B):

He is the Chairman and CEO of LVMH, the world’s largest luxury goods conglomerate

LVMH slightly down, but luxury markets remain wealthy.

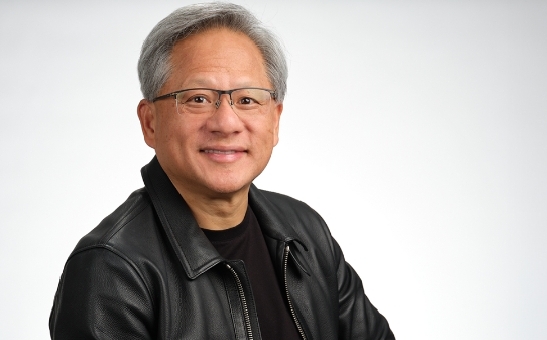

9–10. The Tech Titans

Steve Ballmer (#9, $136B): Microsoft’s surge (~16% increase in May) lifted Ballmer alongside Satya Nadella’s AI-driven Azure push .

Jensen Huang (#10, $123.9B): Nvidia and AI chip dominance pay off—CUDA dominance keeps his fortune climbing.

At a Glance: The New Top 10 (June 15, 2025)

1. Elon Musk – $410.8 billion (Tesla, SpaceX, X)

2. Larry Ellison – $258.8 billion (Oracle)

3. Mark Zuckerberg – $235.7 billion (Meta)

4. Jeff Bezos – $226.8 billion (Amazon)

5. Warren Buffett – $152.1 billion (Berkshire Hathaway)

6. Larry Page – $144.7 billion (Alphabet)

7. Sergey Brin – $138.4 billion (Alphabet)

8. Bernard Arnault & family – $178 billion (LVMH)

9. Steve Ballmer – $136.2 billion (Microsoft)

10. Jensen Huang – $123.9 billion (Nvidia)

…~#87 Aliko Dangote – $23.4 billion (Dangote Group)

Aliko Dangote: Africa’s Industrial Monarch

Wealth: $23.4 billion

Where it comes from: Cement, sugar, fertilizer—and most pivotally, the $20B Lekki Refinery that began full production in late 2024 .

Strategic wins: Nigeria’s fuel autonomy, booming exports to West Africa, and revenue now forecasted at ~$30B annually .

Challenges: A weak naira cut dollar valuation; political and supply-chain politics pose risks.

So what: Dangote proves mega infrastructure can rival tech wealth in global impact.

Reading the Patterns

1. AI Power Surge: Technology moves billions—Ellison, Zillow, Page, Brin, Ballmer, Huang—all riding the AI tidal wave.

2. Equity Leveraging: Higher personal stakes = larger wealth swings. Ellison (41%), Zuckerberg (13%) contrasted with Bezos (9%).

3. Diversification vs Core Focus: Bezos and Buffett slow while laser-focused builders (Musk, Ellison) rise fast.

4. Industrial Wealth’s Role: Dangote’s rise reminds us: tangible infrastructure still matters—especially regionally.

What Lies Ahead?

Battle for No. 2: Ellison’s lead may fade if Oracle’s AI momentum stalls. Meta’s next earnings will be crucial.

Bezos’s comeback?: If AWS-led Amazon AI reboots stock, he may reclaim lost ground.

Dangote’s next frontier: Expanding refinery exports could strengthen his position—but naira stability is key.

Next challengers: Watch Asia and Latin America industrialists—could they break into top 100?

Closing Note

In under 48 hours, a single Oracle earnings call rattled markets and reshuffled the billionaire hierarchy. It showed that age and legacy aren’t barriers—but bridges—to modern wealth.

The billionaire world of 2025 is no longer confined to futuristic consumer tech—it spans the slick of AI servers and the roar of African refineries.

Whether legacy giants can sustain their revival, or digital-native heirs will inherit the top, remains the next act in this high-stakes saga of money, power, and vision.

Leave a comment