While filmmakers, actors, and streaming platforms often take the spotlight, the true power behind Nollywood’s transformation lies in its financiers—tech moguls, venture capitalists, industry titans, and asset managers.

These individuals and entities are not just funding films; they’re architecting a new economic model to elevate Nigerian cinema to global standards.

This is an article of the emerging alliance between artisan storytellers and elite capital—an alliance that’s quietly reshaping one of the world’s most prolific film industries.

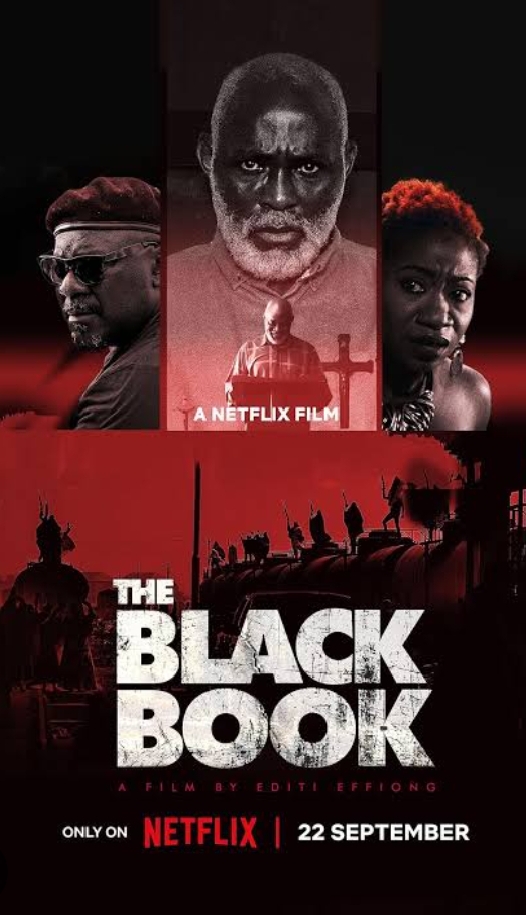

1) The Tech-Financed Rise: The Black Book and VEMA Fund

In September 2023, The Black Book premiered on Netflix and quickly became Nigeria’s most internationally streamed film. It also became the first major Nollywood film funded by a structured tech investment syndicate.

The financing came through VEMA I (Volition Entertainment, Media & Arts Fund), led by Nigerian entrepreneur Kola Oyeneyin.

Designed like a venture capital fund, VEMA raised funds from Nigerian tech founders who had already made their mark in startups and fintech. Confirmed investors include:

Gbenga Agboola – Billionaire and CEO of Flutterwave

Odunayo Eweniyi – Billionaire and Co-founder of PiggyVest

Ezra Olubi – Billionaire and Co-founder of Paystack

Nadayar Enegesi – Co-founder of Eden Life

Olumide Soyombo – Angel investor, co-founder of Bluechip Technologies

This was not a donation. Investors expected returns, tracked milestones, and operated within a transparent governance model. According to Volition Capital’s case study, The Black Book set the blueprint for film-as-asset investing in Nigeria.

The result? A film that was reportedly top-ranked in over 69 countries and a fund that quickly began preparing for its sequel effort: VEMA II, and the continent-wide AFEMA (African Entertainment Media & Arts Fund)

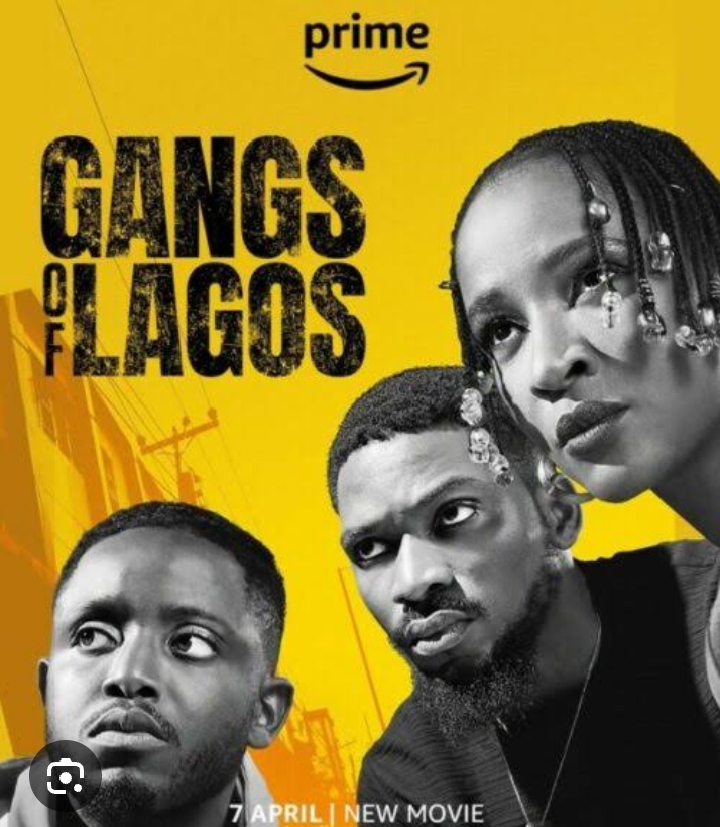

2. Capital Film Productions: Nollywood Meets Asset Management

While VEMA was pioneering syndicate-style equity funding, another structured vehicle emerged: Capital Film Productions (CFP), founded by Adim Isiakpona (ex‑Google) and Hamza Kassim (ex‑Shell), has emerged as another structured investor in Nollywood.

Funding Model: Raised ₦800 million (~US $1 million) across initial funds, targeting 37% cumulative return . Their Act 3 fund is a ₦500 million vehicle slated to back six films in 2024 .

Track Record:

Executive producers of Gangs of Lagos and Brotherhood

Associate producer on Sugar Rush

Strategic Focus: Invest N50–100 million per film, with minimum N10 million investor buy‑in .

Return Window: 18–24 months .

Impact: Gangs of Lagos grossed ₦230 million domestically, hit Prime Video’s top‑10 non-English list, and earned praise internationally .

Capital Film is now pursuing a $50 million fund to scale across Africa.

Capital Film Productions focuses on local stories with global appeal, tight production schedules, and disciplined release strategies—including digital-first distribution and international film festivals.

3. Labari Africa: Building a $3 Million Nollywood Pipeline

Labari Africa Productions, a Lagos-based media investment firm, has pledged over $3 million toward film development, production mentorship, and infrastructure building.

Their flagship title, The Lagos Job, blends heist themes with African urban realism. Beyond financing, Labari invests in:

- Talent mentorship

- Script development workshops

- Production skill-building

Their strategy focuses on grooming new talent, supporting women in film, and creating sustainable, repeatable pipelines for film production.

The firm’s approach mirrors private equity logic: build up assets (films), create recurring revenue (via streaming or syndication), and maximize residual income (through IP).

4. BOI: Nigeria’s First Institutional Film Backer

The Bank of Industry (BOI) was among the first to treat Nollywood as a fundable sector.

In the early 2010s, BOI launched the Nollywood Fund, offering low-interest loans to film producers with proven track records. BOI-backed films include:

Flower Girl (2013)

The Figurine (2009, indirectly via Project ACT)

BOI emphasized domestic film content with global aesthetics, and required applicants to provide business plans, budgets, and revenue projections. Although bureaucratic, the fund demonstrated the viability of public-private collaboration in Nollywood.

5. Netflix, Amazon, and the Global Streamer Shift

While most funders work behind the scenes, international streaming platforms have played a growing role in shaping Nollywood’s direction.

Netflix has commissioned and financed several Nigerian originals, including:

- Lionheart (2018)

- Blood Sisters (2022)

- Aníkúlapò (2022)

- The Black Book (2023)

Netflix typically enters during post-production or distribution stages. Their funding covers global rights, dubbing, and international marketing—bringing immediate visibility but not always financing upfront production.

Amazon Prime Video entered the space with a multi-year licensing deal with Inkblot Studios, a Lagos-based production house known for commercial hits.

These deals add prestige and access but do not solve Nollywood’s pre-production funding gap—which private capital like VEMA and Capital Film Productions is stepping in to address.

What the Quiet Billionaires Are Actually Doing

Across these models, one theme unites all successful funders: they are professionalizing Nollywood’s financial foundation.

They bring:

- Governance structures (clear contracts, milestones, ROI projections)

- Investment discipline (tranches, audits, investor reports)

- Talent development (workshops, mentorship, script doctoring)

- Export thinking (storytelling optimized for diaspora and global platforms)

These investors aren’t philanthropists. They’re betting on a sector with cultural capital, youth engagement, and monetizable intellectual property.

The Public Sector: Project Nollywood & Lessons Learned

In 2013, the Nigerian government launched Project Nollywood, a ₦3 billion grant scheme aimed at building capacity and supporting local productions.

However, the initiative was marred by poor planning, under-delivery, and widespread dissatisfaction among stakeholders. Few commercially successful films emerged directly from the scheme.

The most instructive lesson? Nollywood doesn’t lack talent. It lacks structured, transparent, performance-based funding.

Future Outlook: The Next 5 Years of Nollywood Finance

Here’s what verified trends indicate:

VEMA II and AFEMA: Larger, pan-African versions of the initial fund are in development, aimed at financing films across Kenya, Ghana, Nigeria, and South Africa.

Equity-style deals will rise: More film projects will be pitched like startups, with decks, valuation models, and exit timelines.

IP monetization will increase: Merchandising, spinoffs, series rights, and educational licensing will become major revenue streams.

Alternative investors will enter: Diaspora syndicates, ESG funds, and social impact investors will explore Nollywood as both cultural and financial ROI.

Conclusion: Nollywood’s Financial Coming of Age

From syndicate-backed thrillers to structured private equity models, the Nigerian film industry is entering a new phase. It is no longer fueled solely by passion, improvisation, or one-off investor goodwill. Today, Nollywood is being rebuilt on institutional capital, governed pipelines, and ROI-oriented storytelling.

Tech entrepreneurs, asset managers, and global streamers are reshaping the game. They may never show up in the credits, but behind every high-quality film you stream, there is a quiet investor reshaping Nigeria’s cultural economy.

This is not just entertainment. It’s finance, futures, and film—strategically aligned.

Leave a comment